Disposals

When assets are disposed of either by being written off or being sold there may be a current value which must be offset against the disposal value, resulting in either a profit or a loss which must be reported for income tax purposes.

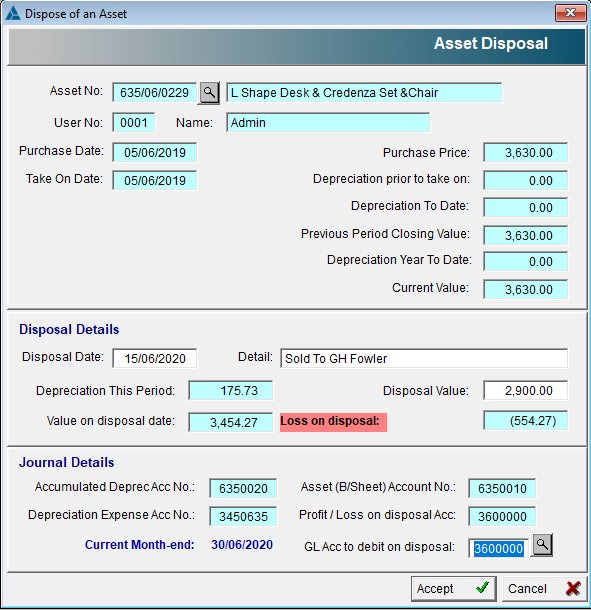

The disposal screen provides for the processing of this transaction.

When an asset is disposed of the system will calculate the depreciation to be processed before calculating the difference between the revised current value and the disposal value and determine if the asset was disposed of at a profit or a loss.

If the disposal is "Accepted: the system will generate two journals as follows;

- Posting the depreciation value

- Posting the profit or loss on the asset and clearing the asset value down to R1-00

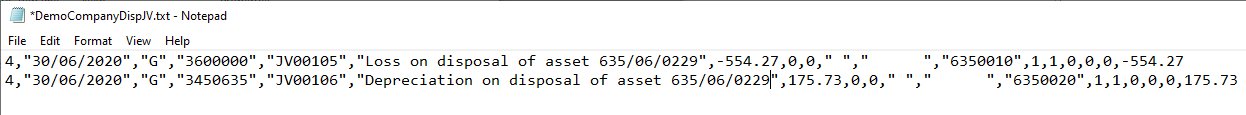

The journals must be exported using the Data Export utility in order to create the export file in the company's "Export" sub-directory.

A sample of the journal export is shown below;